CURRENT TAX ISSUES ON INTEREST EXPENSE WEBINAR SERIES For registration please click at the box below. Malaysias Minister of Finance MOF presented the 2021 Budget proposals on 6 November 2020 announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000.

Malaysian Households During Covid 19 Fading Resilience Rising Vulnerability

Taxation Revenue Product ID.

. On 6 November 2020 Malaysias minister of finance announced the 2021 national budget. The ordinance was repealed by the Income Tax Act 1967 which took effect on 1 January 1968. Evasion is a disease and needs to be minimized so that the black economy or.

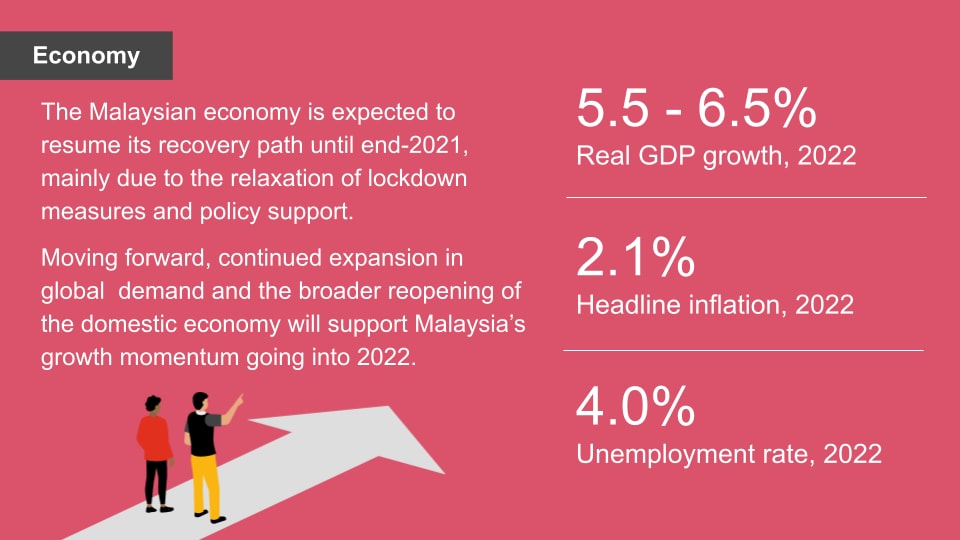

This is the largest ever state budget worth some 3332 billion ringgit US802 billion as the government aims to boost post-pandemic growth. Spotlight On Current Malaysian Tax Issues quantity. This publication covers a range of common tax issues faced by Malaysian taxpayers ranging from corporate to company directors and local manufacturers.

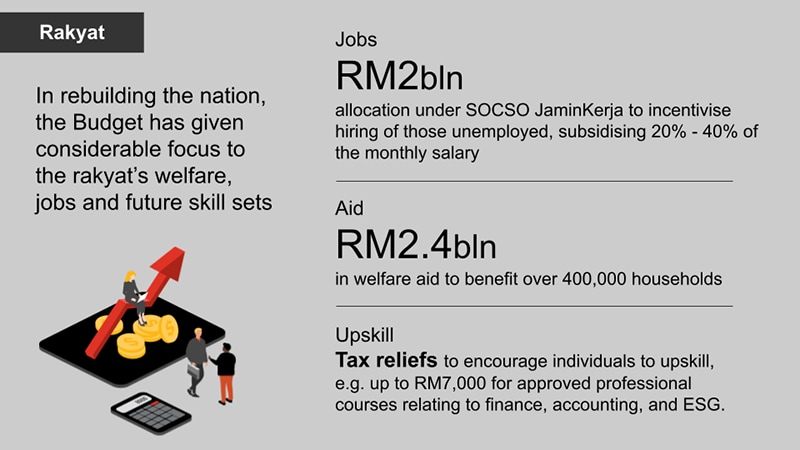

What is the change. In our August 2022 issue we cover the following topics. Up to RM3000 for kindergarten and daycare fees.

Ad Browse Discover Thousands of Law Book Titles for Less. The current issue and full text archive of this journal is available at. 1 There is also an increase an extension and an expansion of the.

The registration fee is inclusive of 6 Service Tax 900 am clients including large multinational corporations a. 100 exemption on import and excise duties sales tax and road tax for electric vehicles. Corporate Tax for 1998 2002 and 2009 Source.

Deloitte Malaysia Tax Leader Sim Kwang Gek said the amount of tax revenue collected should increase in tandem with the gradual recovery of the economy. Areas of coverage include. WEST MALAYSIA BELOW RM150 RM10 POSTAGE ABOVE RM150.

KUALA LUMPUR Nov 16. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system. Determine the business income.

CHAPTER 9 Current Issues in Taxation 90 Topic Outcomes At the end of the lesson students should be able to Explain the scope of charge for e-commerce business Explain the type of business models. Further this is the first budget under the administration of. Income Tax Act 1967.

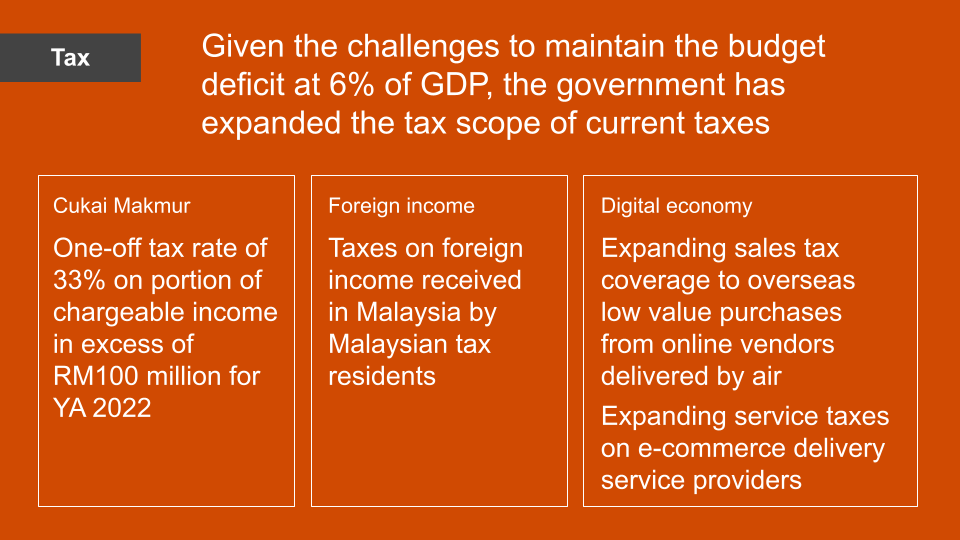

Below are the relevant issues from the individual tax as well as an employers and employees perspectives. Effective Jan 1 2022 a proposal to remove tax exemption on income derived from foreign sources and received in Malaysia by Malaysian residents under Paragraph 28 Schedule 6 of the Income Tax Act ITA 1967 was announced in the recent Budget 2022. Under Pillar One a portion of profits derived by an MNE with global turnover exceeding 20bil RM97bil.

Compliance with International Best PracticeThe Proposal to abolish the. Explain the budget updates and other recent development 91 Source of. Wednesday 27 Apr 2022.

KPMG in Malaysia and brings over 25 years of experience. Keywords malaysia taxation corporation corporate taxpayers tax complexity. Reduce its current tax liability relative to its pretax accounting income.

Authored by our tax lawyers the book provides a practical and legal analysis of current issues faced by Malaysian taxpayers ranging from corporate taxpayers to company directors and local manufacturers. KPMG in Malaysia. Sales tax fully waived for new passenger vehicles.

The IGA was formally signed on 21 July 2021. Currently individuals who are tax residents with a chargeable income. On reducing tax leakages.

Tax evasion particularly in developing countries is a debatable issue. During colonial rule the British introduced taxation to the Federation of Malaya as it was then known with the Income Tax Ordinance 1947. On October 29 2021 Malaysia unveiled a variety of tax measures in its new budget that will impact businesses and individuals in 2022.

Treatment of bad debts. RM9000 for individuals. Taxability of awards of compensation.

Under the IGA reporting Malaysia-based financial institutions will provide the Malaysian Inland Revenue Board with the required. The tax regime in Malaysia should stay current and continue to be sustainable to attract new domestic and foreign direct investments into the country in the. Review of income tax rate for individuals.

12022 - Time Limit for Unabsorbed Adjusted Business Losses Carried Forward. Further large MNEs will be subject to a minimum 15 global minimum tax rate from 2023. Explain the importance and role of Double Taxation Agreements.

Malaysia and the United States had on 30 June 2014 reached an agreement in substance on a Model 1 IGA to implement the Foreign Account Tax Compliance Act FATCA. Bank Negara Malaysia 2014 and Various Issues of Economic Report 1960-2013. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

The ministry focusses on issues of national and international tax policy and is.

Gst In Malaysia Overcoming Adversity Throw In The Towel Frugal

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

Malaysia Sst Sales And Service Tax A Complete Guide

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

7 Steps To Shopping For A Home In Malaysia Infographic Gardening Infographic Infographic First Time Home Buyers

Six Key Challenges Facing Tax Leaders In 2021 And Beyond Ey Malaysia

Malaysia Payroll And Tax Activpayroll

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Contoh Resume Student Uitm Resume Template Resume Job Resume Template

Financing For Sustainable Development Report 2022 Financing For Sustainable Development Office

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SQ2RZSFVLNN23BTMEZHRQEX7BI.png)

Analysis Malaysia S Palm Oil Producers Adjust To Labour Shortages Higher Recruitment Costs Reuters

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Individual Income Tax In Malaysia For Expatriates

Malaysia Issues Tax Exemption For Foreign Sourced Income

Chicago Property Taxes Hit Poorest Disproportionately Tax Debt Tax Attorney Tax Accountant